Blog

PROTECT WHAT'S IMPORTANT:

ADVICE KIWI NEWS

Say up to date with the insurance insights,

information, and news from our team.

By Joel McLachlan

•

20 Dec, 2022

It's almost Christmas! Joel, Steffi and the team at AdviceKiwi want to wish you a very merry Christmas and a Happy New Year. Our office closes on Wednesday, 21th December 2021 and reopens Friday, 20th January 2022. Should you need to contact us urgently during this time, please do not hesitate to email Joel directly - joel@advicekiwi.co.nz Should you need to contact your insurer during this period please use the relevant Free Phone number below: HealthCarePlus: 0800 600 666 AIA New Zealand: 0800 500 108 nib nz limited: 0800 123 642 Southern Cross: 0800 800 181 Fidelity Life: 0800 900 167 Asteron: 0800 737 101 Partners Life: 0800 145 433 Cigna: 0508 464 999

By Joel McLachlan

•

14 Jun, 2022

Don't be like Jim. We love meeting with Self Employed people to help them structure their ACC levies and their Private Income Protection to make sure they're adequately covered, should they become disabled and unable to work. If you are Self Employed and you have haven't looked into ACC Cover Plus Extra; we would love to meet with you to go through your options. Send us a message, we'll buy you a coffee https://sharethis.video/will-acc-actually-cover-you/joel-mclachlan/?cache=62a7e0c5e37ce

By Joel McLachlan

•

07 Apr, 2022

Jennifer (not her real name) had Life and Trauma cover which she took out with her then husband, a few years before we became her insurance advisers. Jennifer wanted to meet with us to talk about taking out new policy just for herself, as she and her husband had been divorced for a year, but their current covers were still jointly owned. Through the process of reviewing Jennifer’s existing policy, she mentioned that she had a heart attack which was trigged through the stress of her relationship breakdown. Her previous adviser had told her that she didn’t have cover for such an event – but that didn’t sound quite right to us. We had Jennifer provide us with the medical information, and we then approached her insurance company on her behalf. The insurer came back within a few days later and confirmed that Jennifer was in fact entitled to a payment of $50,000 under her Trauma Cover Policy. Whilst it is never nice to go through such a traumatic medical event, Jennifer was really appreciative that we had her best interests at heart, and took the time to ensure she got the funds which were rightfully hers. The funds enabled Jennifer to take time to make decisions about her next step in life, without having to worry about her immediate financial future. If you haven’t heard from your advisers in a while – send us a message. We’d love to meet with you to review your covers, and make sure you have the right types and levels of cover in place for your personal financial situation.

By Joel McLachlan

•

18 Mar, 2022

Welcome to our new AdviceKiwi newsletter. We want to keep in touch with our clients regularly, but we also appreciate that insurance is possibly not as exciting for you, as it is for us. So.. we'll keep this quarterly email brief, and hopefully include some stuff that is of value to you, our clients.

By Joel McLachlan

•

22 May, 2021

There are quite a few different types of income protection. Some offset other forms of income, some don't. There's different wait periods before the cover kicks in, and there's differences in the length of time the cover will pay for. There's also different tax implications when you come to make a claim. If you have income protection, and it hasn't been reviewed for a while, we'd love to chat with you. If you don't have any income protection, we'd love to chat with you too. Send us a message, we'll buy you a coffee.

By Joel McLachlan

•

25 Mar, 2021

When you have fantastic staff, keeping them is vital to the future of your business. A great way to ensure your staff feel valued is to provide added benefits such as Health Cover. Not only will it prevent your staff from jumping ship, but it will also enable them to seek medical advice sooner, and get back to work faster when they do get sick. Follow the below link for a helpful wee explainer video https://sharethis.video/group-insurance/joel-mclachlan/?cache=605d15924dd52

By Joel McLachlan

•

17 Aug, 2020

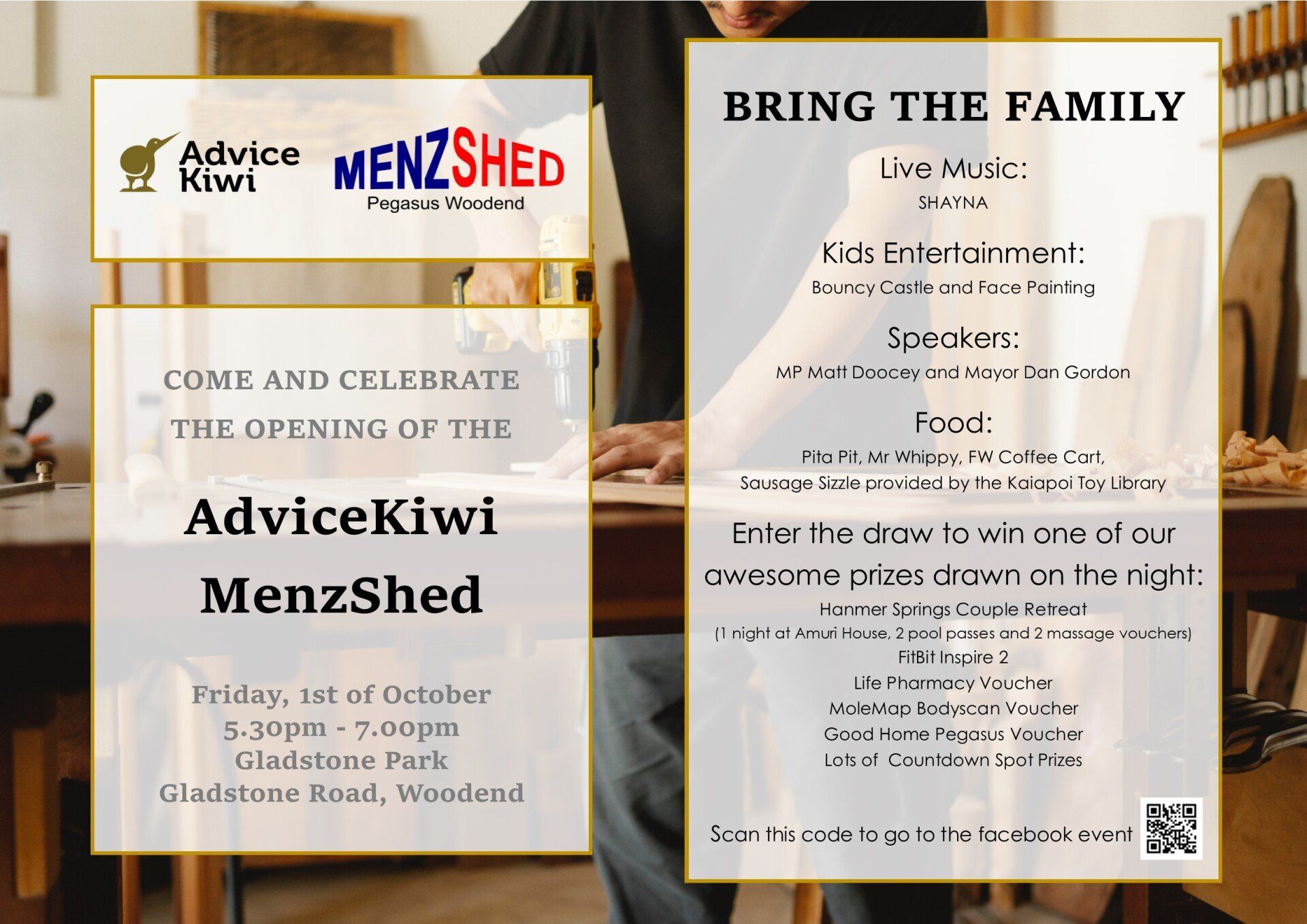

We're delighted to announce that AdviceKiwi has secured $50,000 through the AIA Business & Community Grant, to enable the Pegasus/Woodend...